Next-Gen Financial Business Intelligence Platform for Smart Decisions

- Ad-hoc percentile finding algorithm tailored specifically to the Customer’s application

- Efficient Big Data processing and integration of isolated data silos

- Rich data visualization

Iflexion helped a U.S. data services company with a complete revamp of their flagship product for financial performance analysis and benchmarking.

Context

Our Customer is a data services company providing business owners, research professionals and advisers with a robust web tool to analyze financial performance and benchmark it against the industry average.

The company’s flagship product started going out of date. Seeking to preserve its positions in the market, the company was aiming to replace their legacy platform with a significantly enhanced and improved solution for financial business intelligence while preserving all the current functionality. Drawing on the results of our previous collaboration, the Customer engaged Iflexion for the project delivery.

Solution

Iflexion team made several improvements touching on every aspect of the system, from the user interface and data presentation to functional capabilities and system performance.

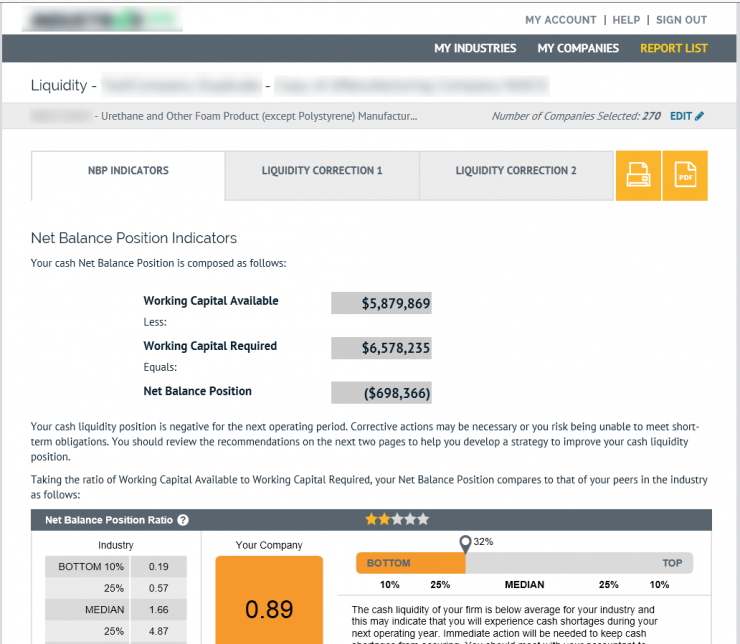

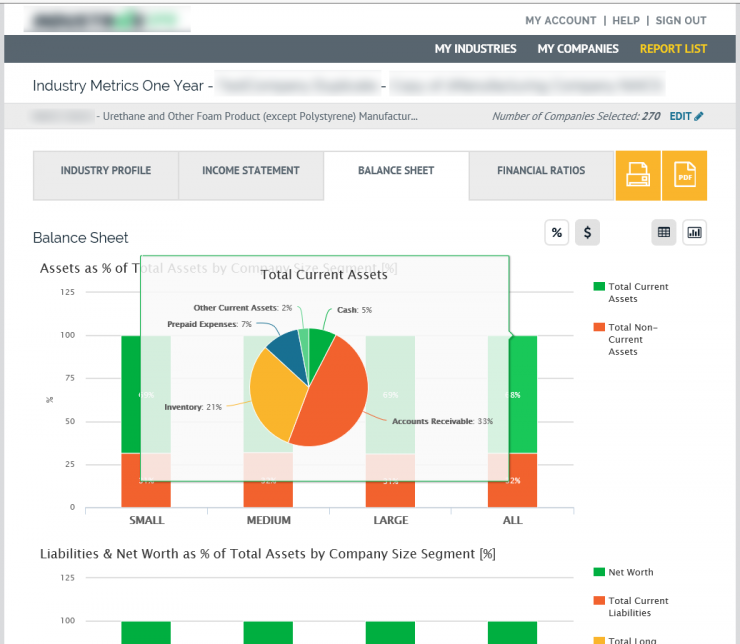

As for its functional structure, the Customer’s solution consists of two major parts: a client-facing website and an administration panel for administrators to monitor user activity and configure system settings. This financial business intelligence platform is accessible on a subscription basis and offers a number of convenient tools to evaluate companies’ business performance, compare individual companies against industry benchmarks or the market average and generate personalized reports and practical recommendations. Driven by a complex business logic, the solution covers a great range of key performance indicators, financial variables, “what-if” scenarios, valuation techniques, etc. in the following analytical modules:

Development Process

Since there was no clarity regarding project requirements at the initial stage of development, the Customer opted for the Time & Materials engagement model, thus reserving the right to change project specifications and add new items in the course of development without losing control of the project budget.

Comprising three .NET developers, a layout designer and a project manager, Iflexion’s project team covered the full range of the project needs, from requirements analysis and clarification through development and integration to testing and maintenance/support.

Our fintech software developers introduced a number of improvements touching on every aspect of the financial business intelligence system, from the user interface and data presentation to functional capabilities and system performance:

- Iflexion’s engineers built a custom, ad-hoc percentile finding algorithm tailored specifically to the Customer’s application to ensure efficient Big Data processing and integration of isolated data silos

- Our team utilized Knockout.js to transfer a portion of data conversion processes to the client side to deal with slow system responsiveness due to heavy data conversion processing on the server side

Technologies

The solution was built on ASP.NET MVC 5 framework that implements a model-view-controller pattern, with a special focus on rich user interface and data visualization implementation. The application’s data resides on a database server MS SQL Server 2012 which formed the system’s persistence layer along with Entity Framework Code First Migrations.

Rich User Interface

- Custom client indicator based on Raphaël.js

- Integration with Highcharts API

- Knockout.js library for transferring a portion of data conversion processes to the client side

Business Logic Layer

- Inversion of Control design pattern to ensure the system is extendable and scalable

- Flexible application log management is via NLog open-source logging platform

- Integration with Authorize.Net payment gateway to enable payment transactions processing right on the website

Database Layer

The application’s data resides on a database server MS SQL Server 2012 which formed the system’s persistence layer along with Entity Framework Code First Migrations.

Results

Iflexion’s engineers have breathed new life into the Customer’s existing service by ensuring its robust performance, fast data processing, and enriched data visualization. The platform was successfully launched, and now is showing a great potential as an ultimate business intelligence tool. Later on, Iflexion’s team developed an API to integrate the system with a number of U.S. banking institutions.

Screenshots

-

![]()

Conference Management Software Development for a US Digital Agency

FULL CASE STUDYA New York-based digital agency turned to Iflexion for custom conference management software to automate event organization and management workflows.

-

![]()

Innovative Web & Mobile Logistics App Development for Seven Telematics

FULL CASE STUDYA fleet telematics device manufacturer turned to Iflexion to develop a multi-functional web vehicle tracking system along with the matching mobile apps for iOS and Android.

WANT TO START A PROJECT?

It’s simple!